Protecting Your Investment in Oakville Real Estate

Just when you think homes in Oakville, Burlington, Mississauga, Milton and the surrounding GTA can’t get any higher – they keep rising! It makes sense to invest in your home, to maintain its value and to bring you top dollar when the time comes to sell. While your home is your biggest investment, it is also where you spend most of your time and make memories with your family. Therefore, it pays to renovate the home to suit your needs and to keep it in top shape.

Just when you think homes in Oakville, Burlington, Mississauga, Milton and the surrounding GTA can’t get any higher – they keep rising! It makes sense to invest in your home, to maintain its value and to bring you top dollar when the time comes to sell. While your home is your biggest investment, it is also where you spend most of your time and make memories with your family. Therefore, it pays to renovate the home to suit your needs and to keep it in top shape.

Many homes in older areas are not updated to reflect current styles and modern comforts. As families grow older, needs often change and remodeling can become necessary to make the space more functional. More room is often needed, so homeowners finish basements or add on home extensions. Other times, walls need to be removed to give a more open floor plan, or windows need to be expanded to let in more light.

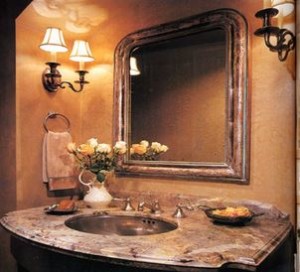

Regardless of how big or small your home renovation project may be, it pays to have expert help rather than try to attempt he jobs yourself – unless you happen to be a contractor. Firstly, it is wise to get an interior designer, so you can plan and visualize what the final results will look like with the help of 3-D renderings and expert advice. Mistakes can be very costly and this step can help you avoid many pitfalls. Secondly, it is important to hire top electricians, carpenters, stone masons or whichever trades the remodeling necessitates. Thirdly, if you do not have the connections or skills to oversee the work being done, it makes sense to hire a renovation project manager. A project manager can hire the necessary trades, order/choose the materials and coordinate the workflow so the project goes smoothly.

Regardless of how big or small your home renovation project may be, it pays to have expert help rather than try to attempt he jobs yourself – unless you happen to be a contractor. Firstly, it is wise to get an interior designer, so you can plan and visualize what the final results will look like with the help of 3-D renderings and expert advice. Mistakes can be very costly and this step can help you avoid many pitfalls. Secondly, it is important to hire top electricians, carpenters, stone masons or whichever trades the remodeling necessitates. Thirdly, if you do not have the connections or skills to oversee the work being done, it makes sense to hire a renovation project manager. A project manager can hire the necessary trades, order/choose the materials and coordinate the workflow so the project goes smoothly.

If you are in Greater Toronto, you can find all you require for your successful home remodeling projects with Divine Home Interiors. This Oakville interior design company can do the 3D imaging plans and print specification sheets for your general contractor. They also do renovation project management, where you can decide how much work you want to undertake, or simply allow them to coordinate a team of reliable and experienced professionals to make sure your projects are completed on time and on budget.

To learn more about their services, visit their website at www.divinehome.ca or call Suzie at Divine Home to book a consultation at 905-466-2503. They also do interior decorating including color consultation, flooring and window treatments as well as lighting. Thinking of selling or you have just bought a home? Make the most of your space with their home staging services. They can also advise you as to which projects bring the best return on investment. Happy renovations!

To learn more about their services, visit their website at www.divinehome.ca or call Suzie at Divine Home to book a consultation at 905-466-2503. They also do interior decorating including color consultation, flooring and window treatments as well as lighting. Thinking of selling or you have just bought a home? Make the most of your space with their home staging services. They can also advise you as to which projects bring the best return on investment. Happy renovations!

Reasons Why You Should Work With an Independent Mortgage Broker

If you’re in the market to buy a home, the first place you may think of when you need to obtain a mortgage is a big bank. While banks do offer mortgages, they are only able to offer limited options to clients in the form of their own home loans. Instead, mortgage brokers, like Verico, are able to offer borrowers many more options, since they deal with the banks as well as credit unions, financial trusts, private lenders and others. If you are new to Canada, self employed, have bruised credit or other especially circumstances that may lead a conventional bank from saying “no” to a mortgage application, you will have a better shot getting approved when you go through a mortgage broker.

If you’re in the market to buy a home, the first place you may think of when you need to obtain a mortgage is a big bank. While banks do offer mortgages, they are only able to offer limited options to clients in the form of their own home loans. Instead, mortgage brokers, like Verico, are able to offer borrowers many more options, since they deal with the banks as well as credit unions, financial trusts, private lenders and others. If you are new to Canada, self employed, have bruised credit or other especially circumstances that may lead a conventional bank from saying “no” to a mortgage application, you will have a better shot getting approved when you go through a mortgage broker.

You’re Protected

Ontario mortgage brokers have a specific goal to provide you with the best and unbiased advice about the mortgage you are looking for. They are obligated to recommend a suitable mortgage for your situation, and why that particular mortgage is right for you. Thus, while low mortgage interest rates are important, you must also understand the other terms and conditions that come with each home loan. Your best interests are always protected when you use the expertise of seasoned mortgage broker since they work for you – not the bank.

A lot goes into getting the right mortgage at the lowest possible rate. It’s not just a matter of looking for the best rate – a lot more needs to be looked at before signing on the dotted line. Mortgage agents are qualified to look into all the little details that are often stipulated in seemingly complex mortgage contracts, making it much more convenient to have a professional work things out on your behalf, and explain everything in terms you can understand. A mortgage agent can sit down with you, go through your finances – including your income, debts, financial goals, credit history, etc. to determine how much you can afford to spend on a mortgage and what you need to do to qualify for low rates. They can also help you plan how to pay off your mortgage quicker, or how to use the equity in your home to finance high interest debt.

It’s The Easiest Way to Shop Around

If you look for a mortgage on your own, you would have to go to different banks and lenders and fill out an application at each one. Having many credit inquiries on your record may hurt your credit score. With a mortgage broker, you fill out one application and they shop it over lenders all across Canada – getting the lenders to compete for your business.

They’re on Your Side

Ontario mortgage brokers don’t work for the bank or any other lender – they work for you. Not only can they save you thousands in interest with the ideal mortgage package, but they do it at no charge to you!

Go With Experience

When you’ve decided that it’s time to get into the real estate market, or you are looking to renew or refinance a mortgage, contact Marcelle Tiqui – a trusted and experienced mortgage agent specializing in mortgages Milton, Oakville, Burlington and Mississauga areas. Call Marcelle at (905) 208-7070 or visit http://www.marcelletiqui.com to learn more about her services. Your home is the biggest investment you will make. Be sure you are getting the best terms and rates by using a mortgage expert like Marcelle Tiqui.

Consolidate Your Debts Using the Equity in Your Home

If you’re like many Canadians, you probably have a variety of outstanding loans, including your mortgage, car loan, and credit card payments. While most Canadians may have a few other outstanding debts to pay, unsecured loans – like store and credit cards- come attached with a high interest rate. The higher the interest rate, the harder it is to pay off such debt. This is why debt consolidation programs are available – to help borrowers to pay off their high interest loans much quicker and easier.

Debt consolidation involves combining all your outstanding loans into one loan amount. This is done usually at a much lower interest rate, especially when compared to credit or store card loans. Not only is this debt easier to pay off thanks to the lower interest rate, it’s also easier to manage, since you’ve only got one monthly payment as opposed to several. When you consolidate debts Toronto Ontario, you can realistically pay off your debt much sooner, providing you with financial freedom sooner rather than later. You will also save much more money in interest payments, and probably have additional cash flow each month – depending on how aggressive you want to be with repayment.

How Can You Benefit from Debt Consolidation?

The benefits of debt consolidation are quite obvious. First of all, this rolled-into-one loan amount will typically come attached with a much lower interest rate compared to the other debt you may have been carrying since it is tied to your home. Credit cards in particular can charge upwards of 20%-30% in interest, making your monthly payment predominantly interest instead of principle, and you end up paying interest on the interest if you can’t pay it off each month. Another advantage for consumers when they use the equity in their homes to consolidate debts is the fact that they only have one loan to worry about, instead of many separate payments all due at different times. This makes it easier to manage and budget each month, and generally improves cash flow with the lower payment.

How to Get Started in a Debt Consolidation Program

How to Get Started in a Debt Consolidation Program

If you’re finding it difficult to manage all your outstanding loan payments, you might want to consider taking advantage of a debt consolidation program. With today’s low home loan interest rates, the difference between a secured home equity loan and unsecured credit card debt can be 20% or higher. An experienced mortgage broker can help you get started with this program, and assist you in getting all your finances in order.

The professionals at Mortgage Medics are seasoned in the world of consolidating debts, and they’ll be sure to help you too! Visit their website today at MortgageMedics.ca or call (905) 847-6611 to schedule a free, no obligation consultation! They can also arrange a second mortgage, home line of credit or home equity loan so you can consolidate debts, make a big purchase, finance education, travel, etc. Put your home to work for you and use the equity to pay down high interest debt and buy the things you need now.

You Can Still Get a Mortgage With Bad Credit!

Bad Credit Doesn’t Have to Stand in the Way of You Getting a Mortgage!

Bad Credit Doesn’t Have to Stand in the Way of You Getting a Mortgage!

If you’ve got credit that’s less than stellar, you probably think you’ll never get approved for a mortgage, right? Well, you’re in luck, because there are still ways to get a “YES” stamp on your mortgage application, even if you’ve suffered poor credit in your financial life!

Dealing with Typical Lenders is Not Your Best Choice if You Have Bad Credit

O f course, typical lenders – like big banks – will more than likely reject your application if your credit score isn’t adequate in their eyes. Lenders will look at your credit score to determine whether or not they will approve you when you apply for a mortgage. While various lenders have their own set of requirements, bad credit is one of the most common factors that will affect a lender’s mortgage approval. This can make finding a mortgage lender Oakville, Milton, Mississauga, Burlington and other areas of Greater Toronto – Greater Hamilton more difficult.

f course, typical lenders – like big banks – will more than likely reject your application if your credit score isn’t adequate in their eyes. Lenders will look at your credit score to determine whether or not they will approve you when you apply for a mortgage. While various lenders have their own set of requirements, bad credit is one of the most common factors that will affect a lender’s mortgage approval. This can make finding a mortgage lender Oakville, Milton, Mississauga, Burlington and other areas of Greater Toronto – Greater Hamilton more difficult.

In addition to your credit score, lenders will look at a variety of different factors relating to your financial strength, including your:

- Housing expense ratio (which should be no more than 32% of your gross income)

- Co-borrowers

- Investments

- Stocks

- Vehicles

- Income history

- Value of your home (if you own one and are looking to refinance or buy a more expensive home)

- Amount of debt (cars, credit cards, current mortgage, student loans, child care, etc)

Let the Experts in Bad Credit Mortgages Help You Get Approved!

Rather than go the typical route of approaching traditional mortgage lender, why not take a better way and deal with an independent mortgage broker who knows exactly who to talk to in order for you to increase your chances of a mortgage approval, even with bad credit? Marcelle Tiqui is a mortgage agent who has plenty of experience getting a bad credit mortgage for those who have struggled with their financial past.

Marcelle has access to hundreds of lenders across Canada, who offer a variety of mortgage products for special situations just like yours. She is well versed in the criteria that different lenders have, and can use this knowledge to help you get approved for a mortgage. Even if you’ve been turned down by the banks, you can still get a bad credit mortgage in Ontario with the help of Marcelle Tiqui. She can also help you with home equity loans – to pay down high interest credit card debt, or mortgage refinancing. Call her at (905) 208-7070 or visit her website: www.marcelletiqui.com. Get your mortgage now- while rates are still low!

Wipe Out Your Credit Card Debt

Many Canadians have a debt for a number of different reasons. Some are still paying off their student loans, some have car payments to make, some financed a home renovation, made a large purchase, and so forth. Among the most common type of debt in this country is credit card debt. Unfortunately, this type of debt is often the most difficult to eliminate, because the interest rates that often accompany these cards are typically extremely high. In fact, they are commonly over 18%, and as high as 30% for some store cards, making it tough to pay down this debt once it starts to accumulate.

Many Canadians have a debt for a number of different reasons. Some are still paying off their student loans, some have car payments to make, some financed a home renovation, made a large purchase, and so forth. Among the most common type of debt in this country is credit card debt. Unfortunately, this type of debt is often the most difficult to eliminate, because the interest rates that often accompany these cards are typically extremely high. In fact, they are commonly over 18%, and as high as 30% for some store cards, making it tough to pay down this debt once it starts to accumulate.

Each month, whatever amount is still owed on your credit card will be subject to this high interest rate. Unpaid amounts also start to accumulate interest, making it more difficult to pay off. The higher the debt outstanding, the more you will be paying in interest charges, which is essentially like throwing your money away. If you don’t get a handle on your credit card debt, you may find it nearly impossible to end the debt cycle.

Make Use of Credit Card Debt Consolidation

While paying off mounting credit card debt may be extremely challenging, there are ways to help the average homeowner to pay down such debt, including debt consolidation.

Debt consolidation basically involves using the equity that you have built up in your home to pay off your debts, – including high interest ones like credit card debt – and consolidate them into one loan payment.

Secured home loans that are based on home equity are considered by lenders to be low risk. By being accepted for a Canadian home equity loan, you can use this freed up capital to pay off your high-interest credit cards and other debts.

Consolidating your debt will allow you to free up cash, which you can use to pay off all of your existing loans. You could save as much as 22% or more, resulting in thousands of dollars in interest savings per year. Using this low interest rate to pay off all your debt means you’ll only need to worry about making one loan payment per month, at a much lower rate of interest. This will help you will cash flow so and can lower your monthly payments. This also translates into paying off debt much quicker and sooner, as more of your money is going towards principal rather than interest.

Options for Credit Card Debt Consolidation

Options for Credit Card Debt Consolidation

If you think debt consolidation is something that would benefit you, call the experts in such financial programs, like Claire Drage from Mortgage Medics, show you your options. You could get a home equity line of credit – which is a set amount but you can borrow and pay back as you need it. Another option is a home equity loan, which gives you a lump sum that you can use to pay credit cards, make a large purchase, fund an education or home improvement project – whatever you need it for.

Claire and her award winning team can help you lower your monthly payments, and save you money on interest payments. She’ll help you get a great rate on second mortgages, secured lines of credit, and more! Contact MortgageMedics.ca today to discuss all your options when it comes to eliminating your debt, and saving thousands of dollars in the long run!

Call today at (905) 847-6611, A Mortgage Medic is standing by!

Rising Mortgage Rates Affects Alberta Home Buyers

Over the last few years, interest rates on mortgages have been at all-time lows. Lately, however, these interest rates are starting to slowly rise again. Locking in for 5 or even 10 years on a mortgage rate – is considered a prudent way to protect yourself before they rise further.

Over the last few years, interest rates on mortgages have been at all-time lows. Lately, however, these interest rates are starting to slowly rise again. Locking in for 5 or even 10 years on a mortgage rate – is considered a prudent way to protect yourself before they rise further.

Due to the rise in rates, many Canadians are also doing they’re very best to pay off their mortgages as quickly as possible to avoid paying more interest. The longer it takes to pay off the mortgage, the more interest will be paid out over that period.

The U.S. Federal Reserve is partly to blame for the rise in interest rates. As bond rates rise, mortgage rates follow suit. The question of whether or not Ottawa needs to step into the Canadian real estate market is still debatable.

Fixed rate mortgages have risen from 3% to 3.5% for a 5-year closed mortgage. Although this may not sound like much, over the duration of a mortgage, this can will amount to quite a bit more interest paid. For example, a $400,000 mortgage at 3.5% with a 25-year amortization period translates into $1,997.09 in monthly payments, with $64,944.76 paid in interest over a 5 year term. Compare that to the same mortgage at 3%, to get $1,892.99 in monthly payments, and $55,477.30 paid in interest over the 5 year term. That’s a difference of almost $10,000 in interest paid over the 5 years.

According to chief executive of CAAMP, Jim Murphy, the impact of higher mortgage rates will most certainly negatively affect first-time buyers, particularly since entering the housing market is difficult enough with sky-high property prices. “All of these changes have impacted the first-time buyer,” said Mr. Murphy. “Now we are seeing rising rates and that will have an impact too.”

It’s extremely difficult to crack the market as it is, let alone with increasing interest rates. Although the real estate market may be affected, your best option is to work with a Calgary Lethbridge mortgage broker who can shop your loan over lenders across Canada to find you the best rates and terms – often saving you thousands in interest over the term of the mortgage. Since a mortgage broker works for you – not the bank – they can give you expert, unbiased advice – and it is free!

To have all your mortgage questions answered, contact Jim Black and his team at Mortgage Loans Alberta, (877) 394-9422, today.

About Ontario Oakville

Ontario Oakville Blog updates about local businesses, services, events and living in Oakville, Canada.